Simple payback period

The simple payback period formula is calculated by dividing the cost of the project or investment by its annual cash inflows. 100 20 5 years Discounted.

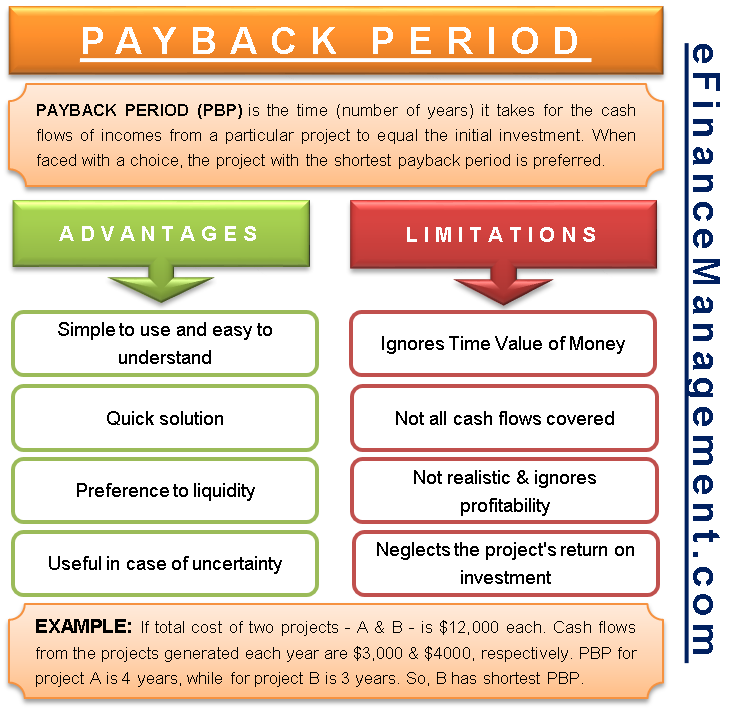

Payback Period Advantages And Disadvantages Top Examples

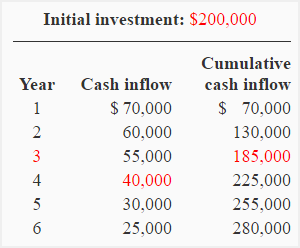

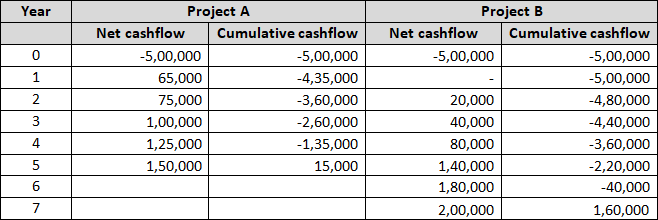

To calculate the payback period you can use the mathematical formula.

. Here is how to calculate the simple payback period. When annual savings remain the same throughout the project period. Payback Period Initial investment Cash flow per year For example you have invested Rs 100000.

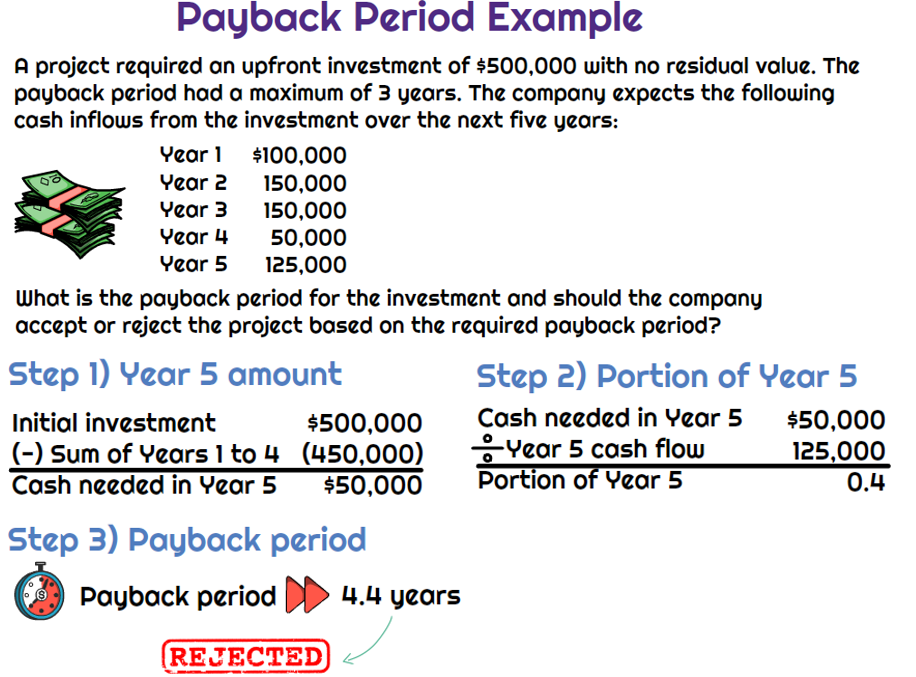

Payback Period Initial Investment Cash Flow per Year Payback Period Example Assume Company XYZ invests 3 million in a project which is expected to save them 400000 each. Payback Period p - np n y 1 n y - np unityears Where n y The number of years after the initial investment at which the last negative value of cumulative cash flow occurs. Payback Period Initial investment Cash flow per year As an example to calculate the payback period of a 100 investment with an annual payback of 20.

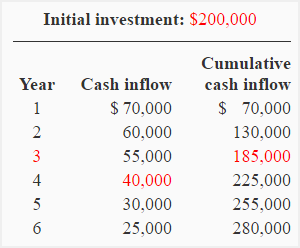

Simple payback period means the value in years obtained by dividing the cost of the investment pertaining to the energy efficiency measure by the economic equivalent of the annual savings. Step by Step Procedures to Calculate Payback Period in Excel The length of time YearsMonths needed to recover the initial capital back from an investment is called the Payback Period. The payback period calculation is simple.

This calculation is useful for risk. What is simple payback period. Simple payback time is defined as the number of years when money saved after the renovation will cover the investment.

Whereas in the discounted payback period a discount. Simple Payback Period Initial InvestmentAnnual cash inflow. Investment Annual Net Cash Flow From Asset It can get a bit tricky when annual net cash flow is expected to vary from year to year.

Simple payback method calculates the length of time within which the future cash inflows of a. As you can see using this payback period calculator you a. Simple Payback Eligible Project Costs typical years earnings before interest taxes depreciation and amortization EBITDA for the project only.

A simple payback period is the required amount of time to get back how much youve spent on an investment. This payback period is essential when making. Difference between simple and discounted payback period method.

May 21 2022 The payback period is the amount of time required for cash inflows generated by a project to offset its initial cash outflow.

Payback Period Business Tutor2u

What Is Payback Period Formula Calculation Example

Payback Method Formula Example Explanation Advantages Disadvantages Accounting For Management

Payback Period Formula And Calculator

Payback Period Formula And Calculator

Payback Period Method Double Entry Bookkeeping

Payback Period Approach Vs Discounted Payback Period Approach Universal Cpa Review

How To Calculate The Payback Period With Excel

Payback Period Method Commercestudyguide

How To Calculate The Payback Period With Excel

B Simple Payback Vs Roi Youtube

Undiscounted Payback Period Discounted Payback Period

Undiscounted Payback Period Discounted Payback Period

Simple Vs Discounted Payback Period Method Definitions Meanings Differences Termscompared

Disadvantages And Advantages Of Payback Period Efinancemanagement

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube

How To Calculate The Payback Period With Excel